By Bridget K. Burke

As healthcare leaders, currently, our resources are being stretched thin, our operational teams are constantly grappling with challenges, and we are being driven to find solutions that optimize revenue cycle initiatives and streamline processes, while trying to maintain financial stability. Doing more with less in the midst of continuously shrinking reimbursements and a pandemic virus that, while considerably less infectious than two years ago, refuses to go away. At the same time, we must provide high quality, safe and efficient care and outstanding outcomes.

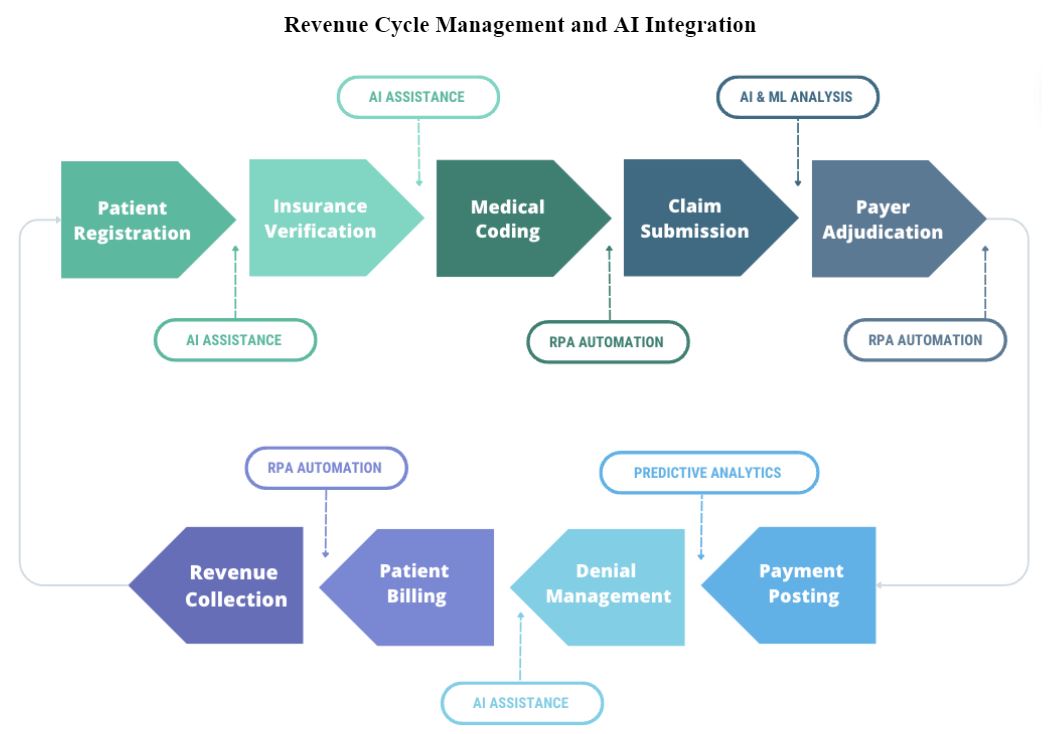

Central to our mission is Revenue Cycle Management (RCM), (Figure 1) the process of registering and scheduling patients, generating healthcare claims from patient care services provided, billing insurance payers and patients and receiving the appropriate revenue. This process is fraught with issues, such as billing and coding errors, slow prior authorizations, and delayed and unpaid claims – all of which can impede productivity, cash flow, and favorable patient experiences.

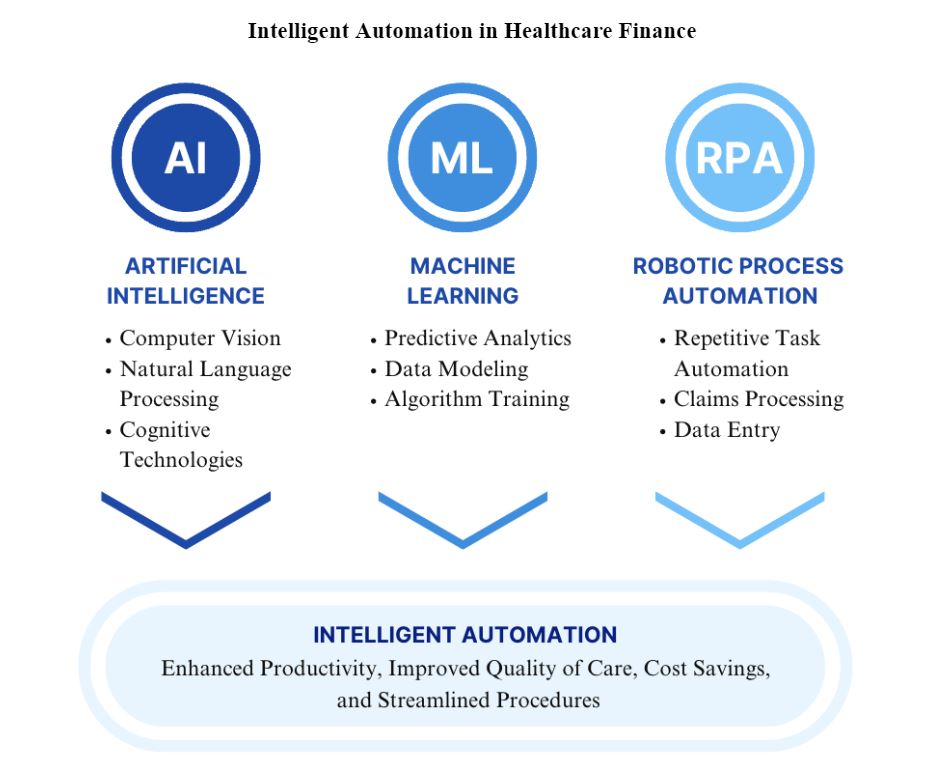

The good news is that Intelligent Automation (IA), which combines Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA), can be of assistance (Figure 2). IA automates semi-structured and unstructured operations using computer-based systems and cognitive technologies including computer vision, natural language processing, and machine learning. By automating back-end patient financial services such as denial management, claims status verification, and patient financial responsibility with RPA, IA can free up staff to focus on patient-centered work such as tackling AR accounts that require more human intervention, enhancing work cue productivity, and improving patient quality of care.

Figure 2. Intelligent Automation in Healthcare Finance

Furthermore, AI appears to be a game-changer in healthcare finance, particularly in terms of improving the reimbursement process. With its applications, for example, predictive analytics, AI can generate cost savings, improve cash collection, and enhance the patient experience by pinpointing the root causes of claim denials and payment delays. Moreover, AI can improve the traditionally manual, labor-intensive prior authorization process. It can reduce procedural steps and speed up payer decision-making, which, in turn, improves both the patient and clinician experience.

Embracing AI can be transformative in the domains of healthcare finance and accounting. Routine tasks such as data entry for patient registration and scheduling can be automated, freeing staff to perform more complex analyses and strategic tasks, such as predictive modeling, building customer profiles for optimized patient collections, resource utilization, strategic decision-making for high acuity cases, and risk analysis.

AI can be integrated into a healthcare organization, e.g., using a Generative Pretrained Transformer (GPT) program such as ChatGPT in a hospital. For example:

- Data analysis: ChatGPT can be trained on hospital financial data to perform data analysis and provide insights into the hospital’s finances. This can help hospital administrators make informed decisions about budgeting, spending, and revenue generation. Suggested steps:

- Identify the financial data that needs to be analyzed (e.g., revenue, expenses, billing data, payment data).

- Train ChatGPT on the data to develop a predictive model that can provide insights into the hospital’s finances (i.e. unpaid patient account balances, costly patient care services that exceed reimbursements, 100% certainty that the claim payment agrees to the payer contracted rates).

- Use the model to generate reports and visualizations that can help hospital administrators make informed decisions about budgeting, spending, and revenue generation.

- Patient billing: ChatGPT can be used to develop an AI-powered billing system that can accurately calculate and generate bills (i.e. claims) for patients. This can help hospitals avoid errors in billing and reduce the time and effort required for billing of claims and receipt from patients of appropriate payment. Suggested steps:

- Identify the billing data that needs to be included for clean, error-free claims sent to patients (e.g., patient information, insurance information, CDM billing information).

- Train ChatGPT on the data to develop an AI-powered billing system that can accurately calculate and generate bills and determine amounts owed by patients, recognizing patient discount from charges where applicable.

- Integrate the billing system with the hospital’s electronic health record (EHR) system to ensure that billing data is up-to-date, accurate and in compliance with claim submission requirements, based upon services provided.

- Insurance claims processing: ChatGPT can be used to develop an AI-powered claims processing system that can streamline the claims submission process and reduce the time and effort required to release claims to the payer. The goal is to submit error-free claims through electronic processing transaction portals and be paid faster. Suggested steps:

- Identify the insurance claims data that needs to be included for clean, error-free claims sent to insurance payers (e.g., patient information, insurance information, CDM billing information, and support documentation). Utilize a bill scrubber in the AI claims processing system as a secondary bill review for coding accuracy and appropriateness before claim submission to payers.

- Train ChatGPT on the data to develop an AI-powered claims processing system that can streamline the claims process (e.g., rapidly identify late charges to reduce bill hold time, monitor claims from bill drop to payer receipt to payer payment for inefficiencies) and decrease the time and effort required to process claims.

- Integrate the claims processing system with the hospital’s EHR system to ensure that claims data is current, accurate and in compliance with payer requirements.

- Fraud detection: ChatGPT can be trained on hospital financial data to identify patterns that may indicate fraud, waste and abuse, or financial mismanagement. This can help hospitals detect and prevent fraudulent billing activities, pre-emptively address problematic and inappropriate coding, avoid payer overpayment recoveries and yield cost savings from appeal avoidances and staff time being focused on work responsibilities, rather than being consumed by payer audits. Suggested steps:

- Identify the financial data that needs to be analyzed (e.g., revenue, expenses, billing data).

- Train ChatGPT on the data to develop a predictive model that can identify patterns that may indicate fraud or financial mismanagement (e.g., impossible billable units, impossible daily billing of services, gender-only services, inappropriate CPT pair codes),

- Use the model to generate alerts and notifications when potentially fraudulent activities are detected for internal review and investigation, prior to the bill drop to the payer/patient.

It is important to note that ChatGPT, as a Generative AI program, is not a standalone software product that can be directly integrated into hospital finance systems. Instead, it requires integration with other software tools and platforms to provide insights and recommendations for financial management.

One-way hospitals can use ChatGPT for financials is by integrating it with their existing electronic health record (EHR) or revenue cycle management (RCM) system. For example, in California, a healthcare organization recently implemented RPA to automate its claims processing. They were able to reduce the time needed to process claims by 75%, which resulted in significant cost savings and increased productivity.

Many of the leading EHR and RCM vendors (Figure 3) are exploring the use of AI and machine learning to help automate financial workflows and provide real-time insights into revenue cycle performance. Some popular EHR and RCM vendors that are incorporating AI and machine learning into their financial management tools include:

- Epic Systems: Offers a suite of financial management tools that leverage machine learning algorithms to improve financial performance. They recently added AI-based voice assistant Suki to their EHR and partnered with Microsoft to use GPT-4.

- Oracle Cerner: Provides AI-powered analytics tools that can help healthcare organizations monitor and improve revenue cycle management. They recently partnered with the FDA and John Snow Labs to create AI-based tools that can extract clinical notes from their EHR.

- Meditech: Provides a suite of financial management tools that incorporate AI and machine learning to improve financial performance and optimize revenue cycle workflows. They recently partnered with Google Health on an EHR-integrated search and summarization solution that uses AI and Natural Language Processing.

Figure 3. EHR Vendors by Hospital Market Share data from Becker’s Hospital Review on May 23, 2023.

By integrating ChatGPT with these or similar EHR or RCM systems, hospitals can potentially improve their financial management by leveraging AI and machine learning to provide real-time insights and recommendations. It’s important to note that successful integration and implementation require careful planning, resources, and expertise. Implementing Generative AI tools like ChatGPT in finance will also necessitate several operational activities, for example:

- Implement cost-cutting measures: After identifying areas where cost-cutting measures can be applied, it’s important to implement them. This could include negotiating with suppliers to get prices reduced, optimizing staffing levels to lower labor costs, or developing more effective ways to deliver care.

- Monitor and evaluate results: It’s important to continually monitor and evaluate the results of finance-related AI initiatives to ensure they are achieving the desired outcomes. This could involve examining financial data to spot trends or using machine learning algorithms to forecast future financial performance.

- Adjust strategies as needed: Based on the results of monitoring and evaluation, it may be necessary to adjust AI strategies to ensure they continue to achieve the desired outcomes. This could involve fine-tuning algorithms or changing the focus of initiatives based on new insights gained from financial data.

- Continually educate staff: To ensure finance-related AI initiatives are successful, it’s important to continually educate staff on the benefits of AI and how it can be used to improve financial outcomes. This could involve hosting training sessions or workshops to teach staff about AI applications in finance, maintaining a dashboard to showcase implemented change initiatives and cost savings or additional net patient revenue from cash collections that avoided bad debt.

- Collaborate with other departments: Since healthcare finance (Patient Financial Services, Accounting, Budgeting, Contracting, Reimbursement, Decision Support, Compliance) is closely tied to both revenue-generating departments and ancillary support departments within a hospital, it’s important to collaborate with these departments to ensure that finance-related AI initiatives align with overall hospital goals. This could involve working with clinical departments to identify areas where AI could improve financial outcomes or collaborating with IT departments to ensure data is properly collected and analyzed, or working with Health Information Management departments to resolve payer denial or delayed authorization issues.

Overall, the key to using AI products like ChatGPT to improve finance in a hospital is to have a clear understanding of the specific financial challenges facing the hospital and to develop a comprehensive strategy that leverages AI to address these challenges. By following these steps and continually monitoring and evaluating results, hospitals can achieve significant improvements in their financial performance and improve margins.

However, we must remain cognizant of potential errors in AI-generated outputs. Even the most advanced AI models and algorithms can make mistakes, and these can lead to financial discrepancies or inaccuracies in accounting records. For instance, if an AI model misclassifies a certain claim based on its training data, it could lead to systematic errors in claim processing. A small error rate of even 0.1% in AI-processed transactions could result in thousands of incorrect entries in a large healthcare organization that processes millions of transactions on an annual basis. Fortunately, the introduction of self-correcting AI systems can reduce these risks. These systems possess the capacity to learn from errors and eventually modify their behavior. Utilizing feedback loops, they can identify and correct their mistakes, as well as enhance their performance and reliability.

Maintaining the integrity of financial data demands a blend of self-correcting AI systems and vigilant human oversight. Regular audits and reviews of AI outputs are crucial to validate their accuracy and correct any errors. This combination of self-correcting AI systems and human oversight can ensure the reliability and accuracy of AI in healthcare finance and accounting.

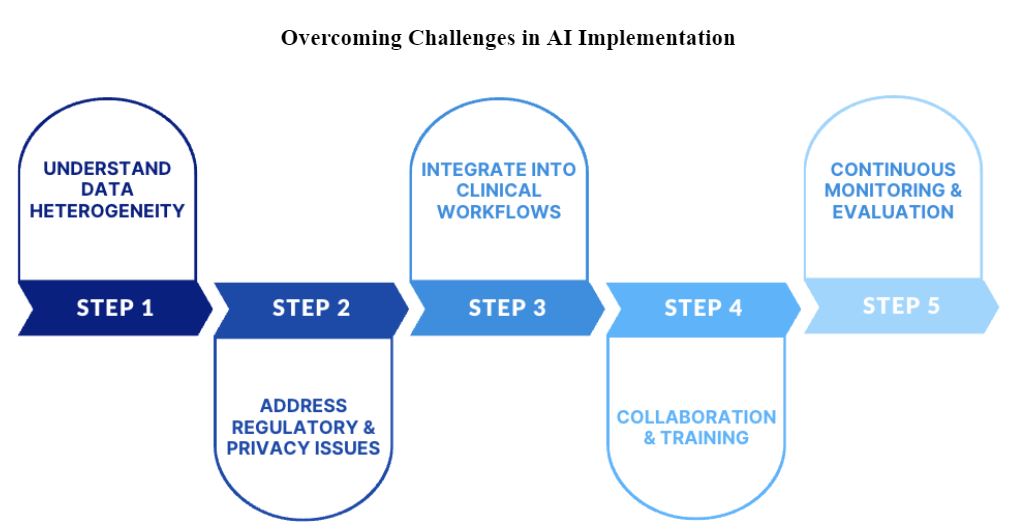

Of course, challenges persist: the heterogeneity of healthcare data may slow AI implementation, the fee-for-service model of payment may provide less incentive for AI adoption, regulatory and privacy issues can pose significant hurdles, and the complexity of integrating AI into existing clinical workflows can be daunting. But, with expertise and effort, these challenges can be overcome (Figure 4).

Figure 4. Overcoming Challenges in AI Implementation

In conclusion, AI and IA, underpinned by RPA, have the potential to improve our healthcare clinical and financial systems. In the domain of billing and reimbursements, AI can streamline claim processing and prior authorization, reducing administrative burdens and costs through improved denial resolutions, timely collection of patient deductibles and coinsurance, and improving the financial health of our organizations. As leaders in healthcare, it is our responsibility to carefully consider how to implement these technology advancements, keeping in mind regulatory requirements, data security and privacy, and the need for human oversight. By doing so, we can strengthen our healthcare systems, enhance patient and staff experiences, maintain compliance with legal and regulatory standards, ensure financial stability, guide healthcare finance with 21st century technology, and ultimately deliver better patient care into the future.

Bridget K. Burke is the Principal Investigator at BridgetLab.ai and a CAHL Finance Committee member. Connect with Bridget on LinkedIn at https://www.linkedin.com/